Getting The G. Halsey Wickser, Loan Agent To Work

Table of ContentsThe smart Trick of G. Halsey Wickser, Loan Agent That Nobody is Discussing5 Simple Techniques For G. Halsey Wickser, Loan AgentThe Basic Principles Of G. Halsey Wickser, Loan Agent How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.The 6-Minute Rule for G. Halsey Wickser, Loan Agent

Home loan brokers help would-be customers discover a loan provider with the best terms and prices to meet their economic needs.

Just the same, there are advantages and disadvantages to utilizing a home loan broker. You should consider them very carefully prior to dedicating to one. Working with a home mortgage broker can potentially save you time, effort, and money. A mortgage broker might have much better and extra access to lending institutions than you have. A broker's interests might not be lined up with your very own.

When you meet feasible home loan brokers, ask to detail exactly how they'll help you, all their fees, the lending institutions they deal with, and their experience in business. A mortgage broker carries out as arbitrator for a banks that supplies financings that are protected with real estate and individuals who wish to get realty and require a car loan to do so.

The Basic Principles Of G. Halsey Wickser, Loan Agent

A lending institution is a banks (or specific) that can give the funds for the realty deal. In return, the consumer pays back the funds plus an agreed upon amount of rate of interest over a details span of time. A lender can be a bank, a cooperative credit union, or other economic venture.

While a mortgage broker isn't needed to promote the transaction, some loan providers may only work via mortgage brokers. If the lending institution you prefer is amongst those, you'll need to make use of a mortgage broker. A lending police officer benefits a lending institution. They're the person that you'll take care of if you come close to a lender for a loan.

The 10-Minute Rule for G. Halsey Wickser, Loan Agent

When meeting prospective brokers, obtain a feeling for exactly how much rate of interest they have in aiding you obtain the lending you require. Ask about their experience, the precise help that they'll offer, the fees they bill, and just how they're paid (by loan provider or consumer).

They also can guide you away from particular lending institutions with onerous payment terms hidden in their home mortgage agreements. That stated, it is helpful to do some research of your very own prior to consulting with a broker. A very easy method to swiftly obtain a sense of the ordinary rates available for the kind of home loan you're applying for is to browse prices on the internet.

How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.

Numerous various sorts of charges can be included in tackling a new home mortgage or collaborating with a brand-new loan provider. These include origination costs, application charges, and evaluation costs. In many cases, home loan brokers might have the ability to get lending institutions to forgo some or all of these costs, which can conserve you hundreds to hundreds of dollars (mortgage broker in california).

Some lenders may offer home buyers the similar terms and prices that they provide mortgage brokers (often, also better). It never hurts to search by yourself to see if your broker is actually offering you a lot. As stated earlier, making use of a home mortgage calculator is a very easy method to reality inspect whether you can find far better alternatives.

If the fee is covered by the lender, you need to be worried about whether you'll be guided to a much more costly lending due to the fact that the payment to the broker is much more rewarding. If you pay the charge, figure it right into the mortgage costs before making a decision how great an offer you are obtaining.

Fascination About G. Halsey Wickser, Loan Agent

Invest time calling loan providers straight to acquire an understanding of which mortgages might be available to you. When a home mortgage broker initially presents you with deals from lending institutions, they usually utilize the term excellent faith estimate. This suggests that the broker thinks that the offer will symbolize the last terms of the deal.

In some circumstances, the lending institution might alter the terms based upon your real application, and you might end up paying a greater price or additional costs. This is a raising trend since 2008, as some lenders found that broker-originated home loans were more probable to enter into default than those sourced through direct loaning.

The broker will collect information from a specific and go to several lenders in order to find the finest possible car loan for their client. The broker offers as the loan policeman; they gather the required info and job with both events to get the finance closed.

Jake Lloyd Then & Now!

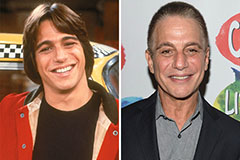

Jake Lloyd Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now!